Business at WahlcoMetroflex is booming | For anti-pollution manufacturer WahlcoMetroflex, a greener world means a boost to the bottom line

New environmental regulations are often cited by businesses as a drag on the economy. But in the eyes of John Powell, president, CEO and part owner of WahlcoMetroflex in Lewiston, new environmental rules offer his business an economic engine.

The company, which manufactures air pollution and gas-flow control equipment for power plants and other industrial facilities, has seen its revenue grow 300% over the past three years, from roughly $10 million in 2005 to expected revenue of approximately $40 million this year, according to Powell. At the moment, the company has a $20 million backlog of work already extending into 2010, says Steven Boulet, a part owner of the company and director of administration.

A large part of that growth is thanks to a March 2005 federal ruling — the Clean Air Interstate Rule, or CAIR — that forced coal-fired power plants in 28 states to install new air pollution control equipment. A shortage of electric power in this country and the resulting increase in the number of power plants being built to meet that demand also has helped boost WahlcoMetroflex’s sales, Powell says. “People are building more and more power plants and whenever they build new ones, they have to have air pollution devices,” he says.

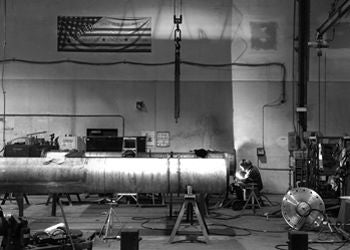

The 36-year-old manufacturing company is housed in a nondescript blue metal building tucked into an industrial park in Lewiston. Although not physically in the public’s eye, the company has not toiled in anonymity. Its growth has been dramatic enough to land WahlcoMetroflex on Inc. magazine’s list of the 5,000 fastest growing private U.S. companies for the past two years. And the U.S. Small Business Administration last year named the company, which generates 25% of its sales from international customers, Maine Small Business Exporter of the Year.

Three hundred percent revenue growth alone is impressive, but it becomes even more so given that seven years ago the company was bought out of bankruptcy by six of its local managers.

Powell says the company was able to realize its rapid growth despite the challenges of high tax burden, the shortage of a skilled workforce and the relative distance to market. While dour headlines may suggest the opposite, manufacturing is not dead in Maine, and WahlcoMetroflex is an example of a company that is growing in the state. “Manufacturing in the state of Maine is a hidden industry,” Powell says. “There’s a lot of manufacturing that goes on unnoticed by the lay person.”

Powell expects to continue a steady pace of growth over the next five years, fueled primarily from growth in overseas markets. And while the domestic market, which has fueled the company’s phenomenal growth so far, is slowing, it will likely pick up again. A federal appeals court struck down CAIR this past July, but Conrad Schneider, the Brunswick-based advocacy director for the Clean Air Task Force in Boston, says future environmental regulations are expected, especially once the Obama administration enters the White House. “There’s nothing out there compelling power plants to invest in emission controls and I think that’s about to change,” Schneider says. “On the horizon I would say the outlook is good for a company that is involved in power plant emission controls.”

The story behind the company

WahlcoMetroflex wasn’t always making headlines based on its success.

The company’s history that goes back to 1972 when Lothar Bachmann arrived in Lewiston with technology licenses from German-based expansion joint and damper engineering companies and launched Tuboflex USA to service Maine’s paper mills. The company was renamed Bachmann Industries and by the mid-1980s had gained a significant market share of the air pollution control in the United States.

In 1990, a company called Wahlco Environmental Systems, a subsidiary of San Diego Gas & Electric, purchased Bachmann Industries and a U.K.-based company called Metroflex, a global supplier of diverters for gas turbines. The two acquired companies were joined under the name Wahlco Engineered Products and at the time held roughly 70% of the worldwide market share of dampers, which regulate air flow through a duct system.

In 1999, a Knoxville, Tenn.-based company called Thermatrix purchased Wahlco Engineered Products, but it was not a good match. Thermatrix soon ran into financial trouble. During this time the Lewiston company was still turning a profit, but its revenues were supporting the floundering parent, Powell says. In 2000, Thermatrix filed for bankruptcy. “And when they went into Chapter 11 they took us with them,” Powell says.

Operating under Chapter 11 was a dark spot for the company, Powell says. The parent was trying to sell off assets to raise capital; the company couldn’t make any purchases without a judge’s approval. In 2000, the number of employees in Lewiston was down to 60 from a high of 125 in 1997.

Seeing the inherent value of the local operation, and not wanting to watch it sink with the parent company, six local managers of Wahlco Engineered Products got together to purchase the company, its intellectual property and patents, the Lewiston facility and its interest in a facility in New Delhi. The deal closed in 2001 and the six local managers — Powell, Boulet, Scott Hall, John Bader, Roger Poulin, Mike Brousseau — along with a seventh minority shareholder got to work building the company back up. “I’ve always had confidence in the ability of our company to be a leader in our industry,” Powell says. “For me it wasn’t an option not to do it. It was how do we get the opportunity to do it?”

WahlcoMetroflex is just one of several companies in the area that can trace its roots back to the original Bachmann Industries. In fact, Bachmann Industries still exists in Auburn, but it is a separate company, that Bachmann founded five years after selling the first iteration to San Diego Gas & Electric. Powell says there are at least five companies in a 25-mile radius of Lewiston, including Design Fab Inc. in Greene, which do similar work to WahlcoMetroflex.

The other companies are considered competition in some respects, although most are not on the scale of WahlcoMetroflex. In fact, Boulet says WahlcoMetroflex often relies on the other companies in the area as subcontractors when its orders outpace its capacity. “A lot of small shops have been busy the last few years as a direct result of our growth,” says Boulet.

Like many of the manufacturers in the state, Powell says WahlcoMetroflex struggles with finding a skilled workforce. “One of the largest sins over the last five years has been the community college system’s getting away from its original mandate to produce technically trained people,” Powell says.

Since community colleges and other programs aren’t churning out enough welders, WahlcoMetroflex and other manufacturers in the area steal employees from each other, Boulet says. He realizes that’s not the best tactic, but says it’s inevitable with the shortage.

Scant skilled workers means you work hard to take care of the ones you have. In early July, the company received national attention when it handed out $100 gas cards to all its employees to help ease the travel costs of celebrating the Fourth of July weekend. The gesture was a hit and company did it again for Labor Day weekend in September.

“The seven of us don’t make it go,” Powell says of he and his partners. “We’re not the ones who make this company successful. It’s the company as a whole that makes the company successful.”

Gauging changing winds

In an interesting turn of events, a federal appeals court in July 2008 struck down CAIR, which had driven so much of WahlcoMetroflex’s growth over the past three years. However, the development won’t mean a sharp drop in WahlcoMetroflex’s sales, Powell says, because the company was already expecting a lull in domestic work. The original deadline for power plants to be upgraded under CAIR was December 2009. “We knew it was coming so we’ve been planning for the last year and half,” Powell says.

During the lull, Powell says the company will more aggressively pursue international work. Fifteen years ago, 75% of the company’s work was international and the rest domestic — exactly opposite to what it is today. Powell would like to see the ratio of international to domestic work level off at about 50-50. Most of the international work will likely come from South America, Africa and Turkey, where the race is on to increase electrical production, Powell says. But Powell’s also watching for opportunities in countries like India and China, which are undergoing rapid industrialization. Powell says the six owners’ minority share in Bachmann India Ltd. in New Delhi could offer a toehold in the region. China is turning on about one new coal plant a week, according to Schneider at the Clean Air Task Force.

In five years, Powell expects the company to double its revenue again. Not only is he betting on more international work, but he expects further regulations aimed at reducing sulfur dioxide and nitrogen oxide emissions in the United States will be instituted. He also says new technology aimed at carbon reduction is a few years away and could offer WahlcoMetroflex further opportunities. “It opens new markets for us with some of the existing equipment we have and opens the path for new products to go into those areas,” Powell says.

To accommodate its growth, WahlcoMetroflex last year invested roughly $5 million in new manufacturing space and equipment. It expanded its manufacturing floor by 17,000 square feet to 48,000 square feet. It was the first expansion since 1992 and the third since the 1980s. It didn’t take long for WahlcoMetroflex to be bursting at the seams again. “We filled up [the new space] before the contractors were gone,” Powell says.

Future expansion will be necessary to accommodate the company’s expected growth, Powell says. But there have been no decisions made as to what it would look like. The company has room for perhaps one more physical expansion on its existing 17.5-acre property, Powell says. After that, an expansion would mean purchasing more space somewhere or even acquiring a competitor, he says.

And there’s no promise that growth will be in Maine. Hall says a Maine facility was well positioned to serve its original customers, the paper mills, but now is far removed from the markets the company currently serves. He says somewhere like Ohio would be a logical place for the company to grow if it were to make an acquisition.

While its future growth may not be tied to Maine, Powell says WahlcoMetroflex isn’t going anywhere, despite the challenges of workforce shortages and distance to market that Maine provides. “We’re home grown people,” Powell says. “We’re Maine kids brought up and raised here and all want to stay here.”

Whit Richardson, Mainebiz staff writer, can be reached at wrichardson@mainebiz.biz.

Comments