Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

View Digital Editions

Biweekly Issues

- December 1, 2025

- Nov. 17, 2025

- November 03, 2025

- October 20, 2025

- October 6, 2025

- September 22, 2025

- + More

Special Editions

- Lists

- Viewpoints

-

Our Events

Event Info

Award Honorees

- Calendar

- Biz Marketplace

E-tailer Chewy sues Covetrus; results may change how you get Rx for Rex, food for Fido

Photo / William Hall

In Yarmouth, Pasta, left, and Apollo each receive a mix of prescription food and medication through both Chewy and Covetrus.

Photo / William Hall

In Yarmouth, Pasta, left, and Apollo each receive a mix of prescription food and medication through both Chewy and Covetrus.

The largest public company based in Maine — and one of the largest animal-health companies, by revenue, in the world — Covetrus Inc. (Nasdaq: CVET) is facing off in the courtroom with another big dog, online pet product retailer Chewy.com.

Chewy Inc. (NYSE: CHWY) is suing the $4.3 billion Portland company over allegations it illegally diverts potential purchases of pet medication and food away from Chewy and into sales for Covetrus.

The suit, filed in New York State Supreme Court this spring, ratcheted up Sept. 24 when Chewy expanded its complaint. Covetrus has a deadline of Nov. 23 to respond.

Also named in the suit is a New York City company, Vetcove Inc., which Chewy claims has conspired with Covetrus in the scheme. Together, Covetrus and Vetcove are “actively building and employing technologies and processes designed to intentionally and unlawfully interfere with Chewy’s relationships with its customers,” the complaint reads.

Chewy, which is based in Dania Beach, Fla., and reported revenue last year of $7.1 billion, is seeking unspecified damages, including Covetrus’ profits from the alleged diversion, and to stop the company from continuing it.

Tug-of-war

At the center of the suit is the way pet parents today buy prescription medicines and food, and a tug-of-war over who controls the scripts.

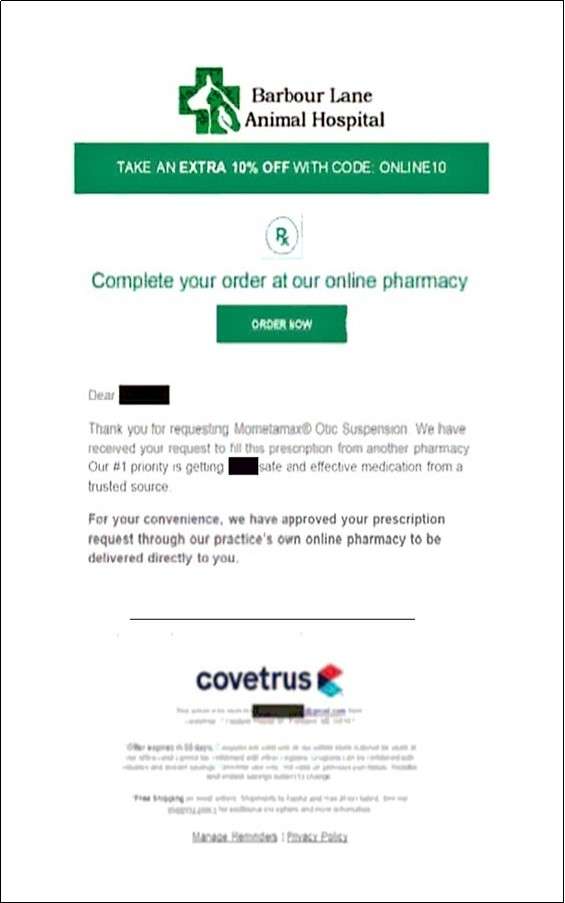

Chewy claims that Covetrus and Vetcove software, used by veterinary practices to manage tasks like medication approval, routinely sends deceptive emails to customers after Chewy contacts a vet about the purchase of a regulated product. Sometimes the messages even say the order has been denied, according to Chewy.

Both Chewy and Covetrus operate online veterinary pharmacies, in addition to selling a wide range of animal-care supplies. Both companies require a vet’s prescription or other authorization before dispensing certain medications and food, and often must contact the vet directly.

But because Covetrus helps run practices through its software, and fills scripts through the Covetrus pharmacy, the company has an inside advantage, according to Chewy.

“Through the access Covetrus obtains via its Prescription Management System,” Chewy wrote in its September filing, “once the Participating Vet completes the Prescription or Authorization Form, and without Chewy’s knowledge or consent, the approved Prescription or Authorization Forms are transmitted not to Chewy — which requested the validation in the first instance — but to Covetrus instead.

“After the completed Prescription or Authorization Form is intercepted by Covetrus, Covetrus’ Prescription Management System reaches out to the Impacted Customer without permission from the pet parent to divert the sale from Chewy to Covetrus. There is no medical justification for this, nor does Covetrus provide such a reason. In doing so, Covetrus’ software generates a misleading email message and sends it to the Impacted Customer.”

However, Covetrus claims it’s responding appropriately on behalf of its clients — veterinarians — as well as animals and owners.

In an Aug. 9 motion to dismiss the case, the company describes what it claims happens when a vet is contacted.

“Not surprisingly, veterinarians sometimes communicate with their clients after receiving solicitations like this from Chewy. One thing they may wish to communicate, if they determine the requested medication is medically appropriate, is that clients can buy medications from the veterinarians’ own clinics — often at better prices.

“Sales of medical products comprise a substantial portion of vet clinics’ revenues and, for some, may be necessary to remain in business and continue providing quality healthcare.”

Beyond the courtroom

There is, indeed, a lot at stake if a veterinarian’s client buys medicine online, cutting out the vet and its vendor, Covetrus.

On average nationally, sales of medication account for one-third of a practice’s revenue, according to financial advisory firm Burzenski & Co. Covetrus serves 100,000 veterinary practices globally. In the U.S., about 12,000 of them — two-thirds of the market — use Covetrus’ prescription management system, the company said in an August earnings call.

But veterinarians also want to keep pet parents happy. Practices sometimes must balance competing goals of selling medication and satisfying customers’ demands.

If a customer wants a prescription sent to Chewy, most veterinarians will do so. But not all.

While 40 states including Maine require vets to provide a script upon request, some practices are reluctant to do so. Across the country, many have posted statements supporting Covetrus or criticizing Chewy.

A large California practice recently shared a Facebook post that read: “Yes, we know Chewy and 1-800-Pet-Meds are less expensive … We can't even purchase these medications at the price those places are selling them for. Small businesses cannot compete with corporate giants. So don't ask them to … It honestly is a slap in the face.”

One Maine practice finds itself caught in the middle.

“We try to remain neutral,” Darcey Thoits, client services manager at Yarmouth Veterinary Center, told Mainebiz. “We do not discourage customers from using online pharmacies like Chewy. We gain compliance, and that can be better for our business."

Whether the clinic fills an order via Chewy or Covetrus, there are direct and indirect costs involved, she added. “Everyone’s complicit in this game.

“We want to make sure animals get what they need, but we’re a small fish in the middle of a big pond.”

Big business

The bigger fish-dogs-cats-birds-other species aren’t saying much about the pending lawsuit.

Covetrus refused to discuss the case with Mainebiz, and answered all questions by referring to the company’s legal motion in August, prior to Chewy’s expanded complaint.

However, Covetrus CEO Ben Wolin touched on the lawsuit in the earnings call that month, in response to an analyst’s question.

“I think Chewy is trying to go around the vet, disintermediate them, and it’s a direct competitor to the vet,” he said. “And so we don’t view it as competition. We have a partnership with our vets to help drive a better outcome, whether that be health care or business, and we’re not interested in trying to move consumers outside of the veterinary channel.”

Chewy spokeswoman Diane Pelkey provided a written statement to Mainebiz, reiterating the company’s stance.

“Covetrus engaged in unlawful and deceptive practices intended to divert a customer order placed with Chewy to a different fulfilling pharmacy (including Covetrus), at times without the knowledge of veterinarians and without any medical reason, preventing Chewy from delivering much-needed medication to pet parents,” she wrote.

“Any situation that interferes with a pet’s health, a pet parent’s right to select the pharmacy of their choice, or that jeopardizes veterinarians is unacceptable to Chewy.”

Both Chewy and Covetrus are going after a market that’s growing, especially as more consumers become pet parents during the pandemic.

They spent $103.6 billion on pet care in 2020, up from $90.5 billion just two years before, according to the American Pet Products Association. The trade group expects the total to hit $110 billion this year.

At the Yarmouth clinic, Thoits said any business lost to retailers like Chewy is more than offset by recent demand. In fact, the clinic is hoping to build and move to a new facility just across U.S. Route 1 from its present location, quadrupling space to 13,000 square feet.

“We were growing before, but we’ve been growing exponentially during the pandemic,” she said.

Thoits said she’s not worried about the outcome of the legal case, since the clinic has good relationships on both sides. But there’s bound to be some fallout for vets, according to a consultant.

“If, for example, the court system decides that Covetrus is correct and Chewy’s business model doesn’t fit within a reasonable VCP relationship, that will take the industry in one direction; if the decision tilts in another way, that will affect the veterinary world in another one,” wrote New Jersey-based Veterinary Business Advisors Inc.

“It’s impossible to predict how the court system will decide this case, but it’s almost certain to affect the veterinary industry.”

Mainebiz web partners

Related Content

I'm not shocked, this Covetrus company has terrible reviews online. I get all my pets meds and food from Chewy, and everything arrives on time, is reasonably priced and I never have any problems. Seems pretty shady using your computer system to usurp another businesses business!

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

Learn More

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

Learn More

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

Learn more-

The Giving Guide

The Giving Guide helps nonprofits have the opportunity to showcase and differentiate their organizations so that businesses better understand how they can contribute to a nonprofit’s mission and work.

-

Work for ME

Work for ME is a workforce development tool to help Maine’s employers target Maine’s emerging workforce. Work for ME highlights each industry, its impact on Maine’s economy, the jobs available to entry-level workers, the training and education needed to get a career started.

-

Groundbreaking Maine

Whether you’re a developer, financer, architect, or industry enthusiast, Groundbreaking Maine is crafted to be your go-to source for valuable insights in Maine’s real estate and construction community.

ABOUT

NEW ENGLAND BUSINESS MEDIA SITES

No articles left

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

Get access now

In order to use this feature, we need some information from you. You can also login or register for a free account.

By clicking submit you are agreeing to our cookie usage and Privacy Policy

Already have an account? Login

Already have an account? Login

Want to create an account? Register

1 Comments