Insider Notebook: Munjoy Hill Historic District planning board hearing, vote set

Photo / Maureen Milliken

The Portland Planning Board is considering a proposed historic district designation for the Munjoy Hill neighborhood. If approved, the designation would go to the city council for final approval. Many residents are concerned about historic buildings being torn down and larger, modern ones going up.

Photo / Maureen Milliken

The Portland Planning Board is considering a proposed historic district designation for the Munjoy Hill neighborhood. If approved, the designation would go to the city council for final approval. Many residents are concerned about historic buildings being torn down and larger, modern ones going up.

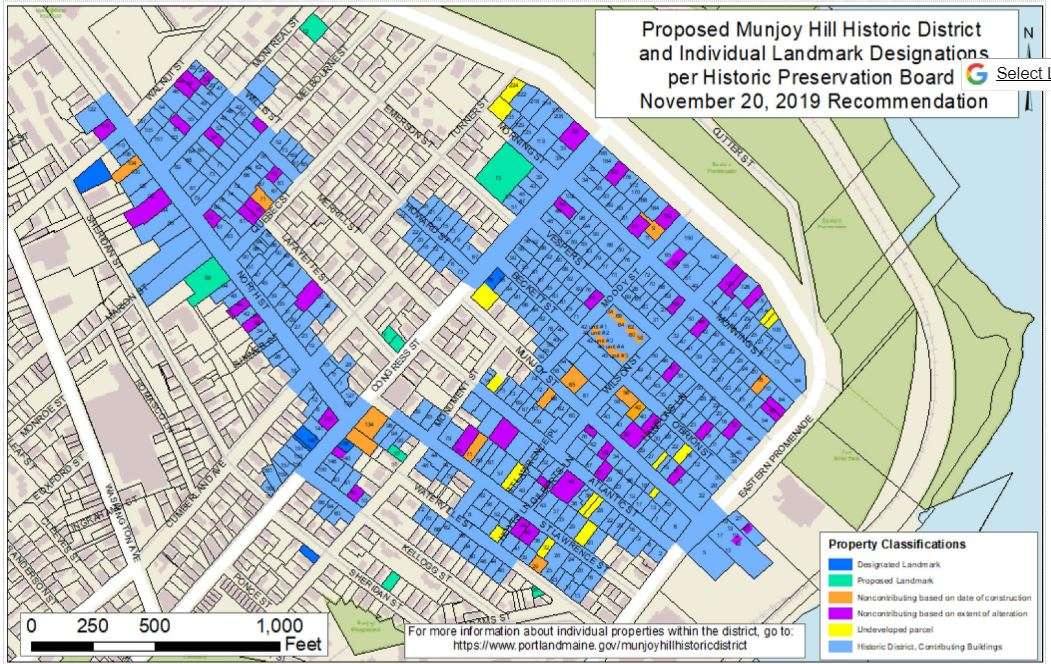

A Historic District classification that would affect more than 400 Munjoy Hill properties will get a public hearing from the Portland Planning Board, tentatively scheduled for March 10, when the board may also vote on the proposal. Final approval rests with the city council.

More Information

The board held the second of two workshops on the proposal Tuesday. It was approved by the Historic Preservation Board in November.

The historic designation was spurred by new development codes in 2015 that encouraged more infill of undeveloped lots, reducing minimum lot size and amount of land required per unit. The changes led to an increase in not only development, but buildings being torn down to replace with new ones, many large and modern. The amount of development raised concerns about preserving the historic, largely residential, neighborhood's character and history.

The district would allow compatible new construction on vacant lots and replacement of buildings that aren't of historic significance. Additions and renovations of historic buildings would be reviewed by the preservation commission.

Demolition of designated landmark and contributing buildings would have to be reviewed and either reclassified or determined to be of no economic use. Exterior changes that are visible from the street would be reviewed by the board for compatibility with the district.

"The proposed review standards for rehabilitation, alterations and new construction on Munjoy Hill are the same as have been applied to Portland’s other historic districts, like large parts of the West End, for 30 years," said the Munjoy Hill Neighborhood Organization on its website. The group supports the historic designation, though some residents have said they're concerned about restrictions for property owners.

Protections of the ordinance are in effect until the city council makes a final decision.

Affordable housing law signed

Gov. Janet Mills Wednesday signed an affordable housing program into law that is expected to spur construction of 1,000 new units.

The legislation, sponsored by Rep. Ryan Fecteau, D-Biddeford, was approved by both the House and Senate last week.

The program provides a tax credit to developers of affordable housing and is expected to double the current rate of housing production in the state, as well as protect U.S. Department of Agriculture low-income housing that's aging out and could become market-rate this year. It provides $80 million in tax credits over the next 10 years, which will be matched by federal tax credits. Because the state wasn't contributing, the federal credits haven't been available to Maine housing developers.

The program "represents the largest investment that Maine has ever made in creating and preserving affordable homes," said Greg Payne, director of the Maine Affordable Housing Coalition, which proposed the legislation.

There are about 52 available affordable housing units for every 100 Maine families earning 30% or less of the median income, according to the coalition.

Preserving the preservation tax credit

Speaking of tax credits, a group of Maine organizations, including Maine Preservation, Coastal Enterprises Inc., Maine Real Estate & Development Association, GrowSmart Maine and Greater Portland Landmarks, are working to secure the future of the Maine State Historic Rehabilitation Tax Credit.

The groups want to extend the sunset provision of the program, which is set to expire in 2023. While that may seem like a way off, the deadline is creating uncertainty for historic rehab projects, according to Maine Preservation. The deadline puts the eligibility of historic rehabilitation costs incurred after Dec. 31, 2023, in question, so five-year projects are at risk now, and two-year projects will hit the deadline in a year.

Supporters of the extension are working with the Legislature, including the Taxation Committee, as well as Mills' office on a 15-year extension.

Maine Preservation is also working with the authors of the 2015 HRTC economic impact report to update economic impact data."This report will show that, when both property taxes and state tax revenue are considered, the program is more than paying for itself," Maine Preservation said in a news release.

A Rutgers University study last year determined developments using the credit in Maine in 2018 added $19 million to the state's gross domestic product and $41.3 million in goods and services.

The tax credit is also aligned with the work of the Climate Change Council and the Maine Economic Development Strategy; both key priorities for the Mills’ administration. "Economic development, growing and attracting talent by highlighting Maine’s unique quality of place, and carbon sequestration are all compelling arguments in support of the HRTC," Maine Preservation said.

0 Comments