Tax reform 101 | Economist Richard Woodbury weighs in on the claims swirling around LD 1495

A referendum this June could mark a turning point in Maine’s decade-long pursuit to meaningfully reform its tax structure. And where there are voter minds to influence, there are claims to debunk. As tax reform friends and foes kick their campaigns into high gear, we’ve enlisted one of Maine’s most consistent and lucid authorities in the tax reform debate, Richard Woodbury, as a voice of reason.

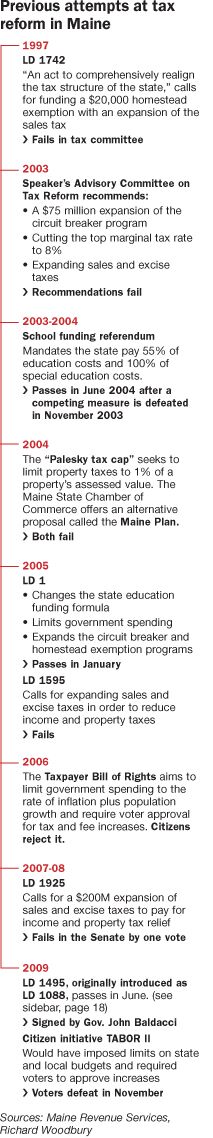

Signed into law last June, LD 1495, among other things, cuts the top income tax rate from 8.5% to 6.5% for those earning under $250,000, boosts the meals and lodging tax from 7% to 8.5% and expands Maine’s 5% sales tax to more goods and services. But a Republican-led repeal effort has put a people’s veto on the June ballot, putting implementation of the law on hold.

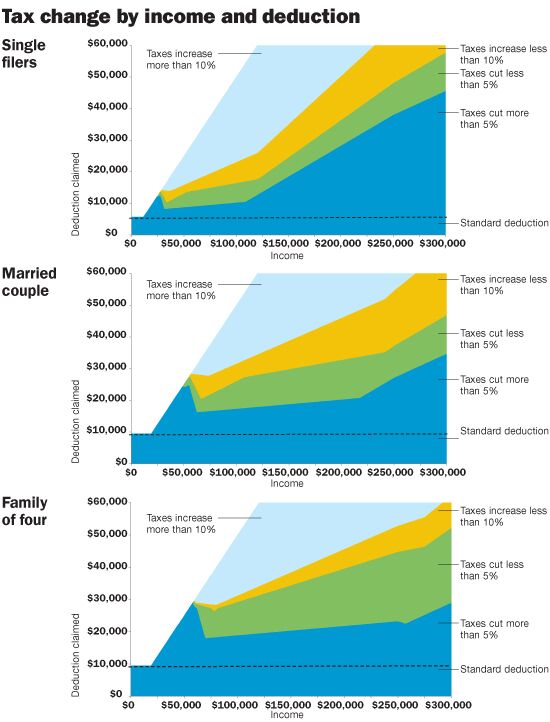

Woodbury, an economist, in March released a study titled “Income Tax Reform in Maine: How It Works and Who Benefits,” as a follow up to research he began last year as a visiting scholar at the Federal Reserve Bank of Boston. The 18-page study is a plain-spoken explanation of the mechanics of both the reformed system under LD 1495 and the existing tax structure, and spells out how the reform would affect individual income tax assessments. The gist: Taxpayers with high itemized deductions from well-off households would often pay more under the reformed law. Almost all taxpayers who use the standard deduction or who claim low to moderate itemized deductions, however, will pay less, regardless of income level.

Woodbury is a go-to resource for those seeking to understand Maine’s tax structure. A former legislator from Yarmouth and one-time chairman of the Legislature’s tax committee — who’s again running for office, as an independent for the state Senate — he’s not lacking in opinions about how Maine’s tax code should be structured. He has advocated for widely expanding the sales tax in order to greatly lower income taxes, beyond what the new reform law outlines.

But Woodbury has provided much-needed perspective in the lead up to the June referendum, when voters will go to the polls to decide on what some call the state’s most significant tax reform in 40 years. We ran some of the most oft-repeated claims past him. Below is somewhat of a Maine Tax Reform 101: The myths and realities of LD 1495.

Claims made by opponents of LD 1495

CLAIM: Taxpayers, especially businesses, will be hurt by tax reform’s elimination of personal exemptions and deductions.

Woodbury: For the large majority of taxpayers, what they have as personal exemptions and deductions now, there’s a parallel in the new system in the way that the household credit works. So it’s not exactly that those things are being eliminated. But it is true that there are limits on them for the first time. For a married couple, the limits are somewhere around $27,000 of itemized deductions. If you try to look specifically at who would end up paying more taxes under the new income tax system, it’s people who have really been very, very high itemizers in the past. It may be that people are choosing a very expensive home where their mortgage payments and property taxes add up to something that gets them over that level. It may be large charitable contributions, it may be large medical expenses. An effect of this reform is that it limits the extent to which you can use those things for income tax reduction.

Having said that, it’s 5% of taxpayers who will pay more income taxes in 2010 under the new system than they would under the old system. It’s a relatively small group that’s adversely affected by that change, but they are adversely affected.

Most of the expenses that a small business person incurs, they report on Schedule C as a business expense. The changes here have absolutely nothing to do with how the business expenses get deducted. There’s absolutely no limit on business expenses — that is exactly the same under the new law as it is under the old law. It’s only the personal side of your life in which this potentially is limited. I don’t think there’s any downside here, and the potential upside is that on the margin you’re likely to be paying a lower tax rate on the income than you were before.

It is possible that some people who have very high itemized deductions may choose to do some of those same things through their business instead.

CLAIM: Any savings in income taxes will be offset by increases in sales taxes.

Woodbury: Maine Revenue Services’ analysis certainly finds some people who are going to end up paying more, either because their income taxes are more or because the sales taxes end up going up more than their income tax is going down.

A second thing is that there are specific types of businesses where the things they are selling — dry cleaning, go-karting, auto repair — will become subject to tax. So I guess the question you ask is A, how much is their business going to decline as a result of the fact that they now have to impose a sales tax, and B, do they feel that they have to absorb some of the cost of that sales tax as the owner of the business rather than passing it all to their customers? That’s a really hard thing to estimate in advance.

Will everybody be better off from this thing? No, probably not. So then you’re just weighing overall, do you have something that’s better for the economy or worse? My instincts are that this 8.5% rate has been such a problem that this is going to be a marginally better system.

CLAIM: Tax reform will scare away visitors by increasing the meals and lodging tax.

Woodbury: People need to draw on their own instincts about that. What it doesn’t change is the competition between one lodging establishment and another one. It’s a question of whether somebody decides to go to a different place, as in a different state, rather than Maine, because of the increase in the sales tax from 7% to 8.5%.

CLAIM: LD 1088, the original bill, was rushed through the Legislature.

Woodbury: Tax reform is never going to work unless the public buys into it as something that’s credible... In many ways I like that it’s now in a public referendum format because now we get to figure out whether this is something that the public views as a credible change. That’s just got to happen for this to work. I don’t have a comment on whether a particular bill was rushed through.

CLAIM: Tax reform is a giveaway to the rich.

Woodbury: I don’t think there’s any way to lower the top income tax rate and not have the tax burden go down on relatively well-off people, particularly at the very highest end. I think a lot of effort was made by those who crafted this legislation to spread the gains across a broad range of the income distribution. But if you’re worried about your 8.5% being a disincentive to the economy and you want to lower that 8.5%, a lot of the gain is going to go to people who are paying a lot of their income at that high rate.

Claims made by supporters of LD 1495

CLAIM: If voters say no to tax reform and repeal the law, income taxes will increase for 95% of Mainers.

Woodbury: [Laughs]. All that is is an argument about what is the status quo. Is the status quo that the law passed or is the status quo that the law has not passed? I trust Maine Revenue Services’ analysis that says in 2010, 95% of taxpayers will pay less under the reformed approached than under the old approach.

CLAIM: Repeal would harm business growth with high capital gains taxes and income taxes.

Woodbury: The headline of this law is that it lowers this top rate from 8.5% to 6.5% for most people. There is a marginal tax rate in the new law that is in fact 8%, because there’s this range where people are getting the household credit, and the household credit phases out at 1.5% of your income above some level. So you’re kind of paying a 6.5% tax and in addition you’re subject to the 1.5% phase out, for a total 8% marginal tax rate.

How you think about capital gains taxes I think still needs to be considered in this context. Some capital gains will be reduced from 8.5% to 6.5% or 8.5% to 6.85%, but some will get reduced only from 8.5% to 8% if you’re in this phase-out range. So it’s lower in every case — I think most would say that’s an economic positive. It’s probably exaggerated a little bit by the advocates.

CLAIM: Repeal would raise state income tax rate by nearly 30% (from the proposed 6.5% to the old 8.5%)

Woodbury: I find that statement a bit hyperbole. Our published rate of 8.5%, I think it’s discouraged economic activity in part because of the rate itself and in part because of all the publicity and reputation around it. There may be something to the publicity and reputation around our 6.5% rate that will help more than the reduction in taxes itself.

CLAIM: Repeal would eliminate taxes paid by people from out of state.

Woodbury: Part of the pitch that is made about this whole thing is that’s it’s lowering the tax burden on Maine residents. It does that partly because when you raise the sales tax you are taking in revenues from people who are in Maine as residents and people who are in Maine as nonresidents... So if you raise sales taxes, you extract something from that population, which may not pay income taxes. That’s a big piece of the exportability here.

The other piece is within the income tax itself. That’s part of what this switch from a deduction-based system to a credit-based system is trying to accomplish, in that the credit is something that the law assigns to residents only. Effectively, for nonresidents, this becomes like a 6.5% flat tax, whereas for residents they have the 6.5% flat tax but then they get this credit and they get it because they’re residents, to offset some of the costs of being a resident here. I’ve certainly heard that there are potentially constitutional challenges ahead to whether that’s an allowable differentiation.

Jackie Farwell, Mainebiz senior writer, can be reached at jfarwell@mainebiz.biz.

DOWNLOAD PDFs

Comments