Where there is a will, there is a way — Don’t forget to write out your intentions

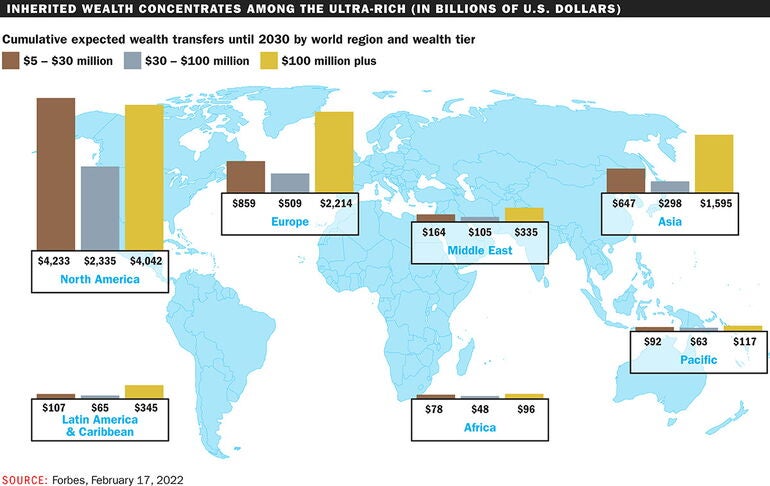

The United States is in the midst of the greatest wealth transfer in history. Over the next two decades, an estimated $84 trillion will be passed down from baby boomers to family members, charities and trusts.

The wealth transfer not only affects those directly leaving or receiving assets, but it is also a factor in the overall economy, says Gary Bergeron, executive director and a family wealth advisor at the Breakwater Group at Morgan Stanley.

“There is an unprecedented transfer of wealth occurring in the next few decades. The public should be aware of this transfer because it impacts many areas of people’s lives where life intersects money,” he says.

According to Bergeron, the upcoming wave of wealth transfers will go smoothly for well-planned estates, but others may be bogged down in legal work for years due to family bickering and inefficiencies. Heirs may also not be prepared for the life-changing impact inheritances could have on them.

“As I share with clients often, you would never put a first-time driver behind the wheel of a new Ferrari without any training or conversation — there would simply be too much risk,” Bergeron says. “In the same vein, you would never want to leave an untrained, unprepared person in charge of a large company or millions of dollars.”

Estate planning

Despite the surmounting wealth transfer on the horizon, studies reveal that more than half of Americans do not have a will or an estate plan. Whether a multimillion-dollar company or the well-earned life savings of middle-class grandparents, estate plans are key to ensuring assets and control go directly to those designated by the testator, or person writing a will.

“Working with a professional to develop a clear, legal, and written plan is the only way you can control what happens to your affairs after you pass,” Bergeron says. “In many cases, it also allows a client’s affairs to be settled with efficiency. You can, of course, die without a will. Your estate will eventually be placed with family, but only after the court reviews all the details of your situation and directs which assets should be passed on to which family members.”

Bergeron’s steps for estate planning

A will or trust: This document is critically important so that your heirs are able to inherit without large legal fees, long time delays, or burdensome court filings. Without these documents, distribution of wealth is left to the courts, which takes control out of the family’s hands and rarely works out as well.

Durable power of attorney: “We like to say to clients that a will is important, but you only need it once,” he says. A power of attorney, on the other hand, could be more important as someone may need the document multiple times over many years. This power allows someone to help people make legal and financial decisions when they either don’t want to or can’t make them on their own.

Durable power of health care: In the same way, if a person cannot or does not want to make health care decisions on their own the durable power of health care allows a chosen person or loved one to make those decisions for them.

Planning allows families to navigate the unexpected and follow through on the wishes of the deceased. In the bigger picture, the upcoming wealth transfers could have a domino effect as money, control, and business power change hands through the generations rapidly. Creating a plan in the present will provide security for the future.

“Many of our clients are part of the very fortunate group of humans who enjoy intelligence, good fortune, good family, good health, and a long life. Sadly, life doesn’t always work out that way and many people are forced to deal with real struggle, unplanned expenses, and even death,” Bergeron says. “While we can’t eliminate the challenges that life throws at us, with planning, we can at least try to minimize their impact.”

0 Comments