Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

Despite economic factors, Maine real estate continues to be hot property

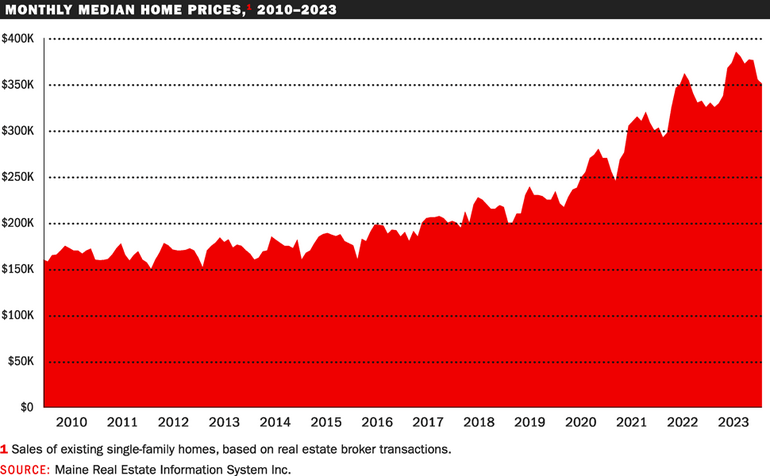

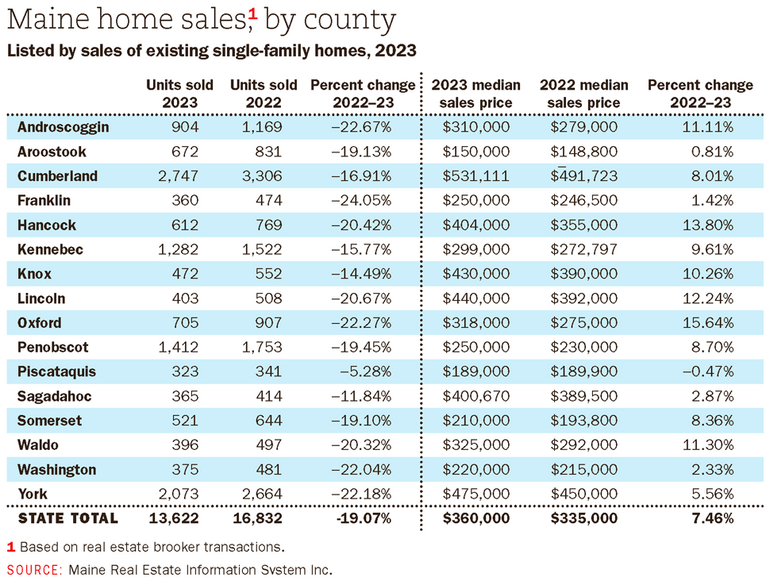

Higher interest rates, changes in migration patterns, higher prices, less inventory — none of these factors stood in the way of a surging real estate market in Maine.

Throughout the past year, real estate has continued to be hot property.

Here is a look at some different real estate-related trends.

The median home price in Maine breaks the $400,000 mark for the first time

The median price of $406,000 during June was an increase of 5.45% compared to the figure for June 2023, according to Maine Listings. May’s median sales price, $398,250, had previously been the highest recorded in Maine.

Across Maine, 1,291 homes sold during June, a decrease of 10.03% compared to June a year ago.

“For the fourth consecutive month, we’re seeing a notable improvement in the number of homes for sale in Maine,” said Paul McKee, president of the Maine Association of Realtors and a broker with Keller Williams Realty in Portland.

It’s been 35 months since the inventory of homes for sale surpassed the current level of 4,400.

“While the number of sales is down in June, for the first six months of 2024 homes sales are up 2.4% compared to January through June 2023,” said McKee. “The improving for-sale inventory level is good news for buyers.”

Nationwide, sales decreased 4.3%, comparing June with a year ago, according to the National Association of Realtors. Prices increased 4.1% to a national median of $432,700.

Regionally, sales in the Northeast eased 6% while the median price rose 9.7% to $521,500.

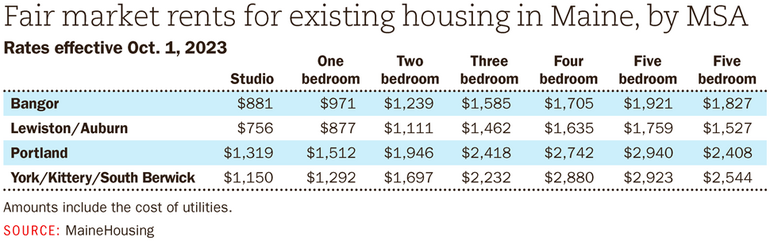

Affordable housing continues to be a concern for residents and employers

Maine’s housing shortage has hit a fevered pitch. MaineHousing said in its annual report that affordability remains one of the biggest challenges in meeting housing demands.

Maine will need at least 84,000 new homes within the next seven years, the state housing agency said in a report that came out in October 2023. The housing agency said at least 38,000 homes just to meet the current demand. The figure exceeds the current inventory by 5%.

In its report, MaineHousing doubled down on the goal of providing affordable housing.

“The challenge of creating enough safe, warm and affordable homes for all Maine people has never been more daunting. The costs of building materials, labor, land and capital are all at historic highs. The latest U.S. Census data shows us that Maine continues to hold the dubious demographic distinction of being the ‘oldest’ state in the nation,” Daniel Brennan, director of MaineHousing, wrote in his introductory letter in the annual report.

He cited a bright spot: Maine’s population is “rebounding as we see a steady uptick in people choosing Maine for their new home, drawn to our high quality of life and in search of something better for themselves and their children.”

Last year, MaineHousing’s home-ownership department purchased $172.7 million in loans, or 820 total loans. The average loan was $210,611, while the average purchase price was nearly $230,000.

“This allowed buyers to obtain properties in good condition and ready for occupancy,” MaineHousing said in the report.

It’s harder and harder to find affordable houses.

While Maine’s median sales price topped $400,000 for the first time in June, Maine Listings data shows that the most expensive homes are in two of the most populous southern Maine counties, Cumberland and York.

In 2023, 751 units of affordable housing were added at a total of 19 projects, MaineHousing said in its annual report.

This year 1,852 units are under construction.

Significant funding for affordable housing is coming from various sources, MaineHousing said, citing programs like the Rural Affordable Rental Housing Program, created under Gov. Janet Mills’ Maine Jobs and Recovery Plan. The program is part of an investment of $1 billion in American Rescue Plan funds for a wider range of economic development, including job creation.

The first project coming to fruition under the Rural Affordable Rental Housing Program is 55 Weston Ave. in Madison — a project that has an added bonus of using insulation manufactured at the new TimberHP plant elsewhere in Madison.

The American Recovery Plan also helped fund the Affordable Homeownership Program, which is using $10 million in funding channeled through the Maine Jobs and Recovery Plan.

Also last year, MaineHousing awarded a contract to the Brunswick-based Genesis Community Loan Fund to assist municipalities, economic development groups, cultural organizations and others in developing new housing, particularly in rural areas.

Luxury and ‘turnkey’ houses still fueling the housing market

Despite the need for affordable housing, the sale of a three-bedroom “cottage” in Falmouth Foreside shows that Maine’s housing market, though cooler, can still command high prices.

The house, at 36 Old Mill Road, sold for $1.425 million, according to Benchmark Real Estate, which brokered the sale.

The home, which dates to 1920 and was refreshed this year, has views of Casco Bay from nearly every room. It has three bedrooms, three full bathrooms, two primary suites, a “chef-inspired” kitchen and exterior features like a firepit, patio area and perennial gardens.

The property includes deeded rights to Mussel Cove beach and dock. Located in a serene and private area, it’s only 10 minutes from downtown Portland, which Benchmark said appeals to a buyer “seeking luxury combined with convenience.”

The property was assessed at $1.2 million, according to Zillow. The home is 1,789-square-feet and the lot size is 5,227 square feet.

And, as Realtors like to say, it’s about “location, location, location.”

Cumberland Foreside has Maine’s priciest ZIP code and is one of New England’s 50 most expensive ZIP codes, with a median home price of $1.23 million, as Mainebiz reported recently.

Maine has roughly 500 properties listed at $1 million or more, including 28 listed at more than $5 million and four listed at more than $10 million, according to the real estate site Trulia. Overall, there are more than 5,800 properties listed.

Tom Landry, broker-owner of Benchmark Real Estate, which brokered the Falmouth Foreside deal, said location continues to be “the golden rule.”

But, as the pandemic-fueled real estate market shifts to a buyers’ market, people are looking for move-in ready homes. He said buyers are still looking to Portland and area towns for plum properties — in some cases, still going through bidding wars.

“People are looking for ‘turnkey’ homes. They don’t want a project. [Many buyers] are moving from outside the market; they don’t know anyone here. They don’t want to have to hire a contractor. But they may be able to afford $1.2 million or $1.3 million,” especially if they sold a house in a pricier market, Landry told Mainebiz.

Markets that might have had pre-pandemic median prices of around $425,000 might have jumped to $700,000 in a two-year period, particularly in areas with highly rated schools and walkable downtowns, he said.

“COVID took a match and some accelerant” to the Maine home market, Landry said.

Portland and surrounding towns are seeing some softening, he said, but values are coming down by 10% after nearly doubling in recent years.

The $1 million-and-up market is not being as affected as the market around $400,000, which is being affected more by higher interest rates.

“Buyers could ratchet up when rates were lower. People were ‘up-shopping,’” Landry said.

“We’ve seen a softening of the middle market. We’re transitioning to a buyers’ market, but not on everything,” he added. “We’re still seeing bidding wars on some properties, but others are sitting.”

0 Comments