Greater Portland Immigrant Welcome Center offers $4K microgrants for immigrant-owned businesses

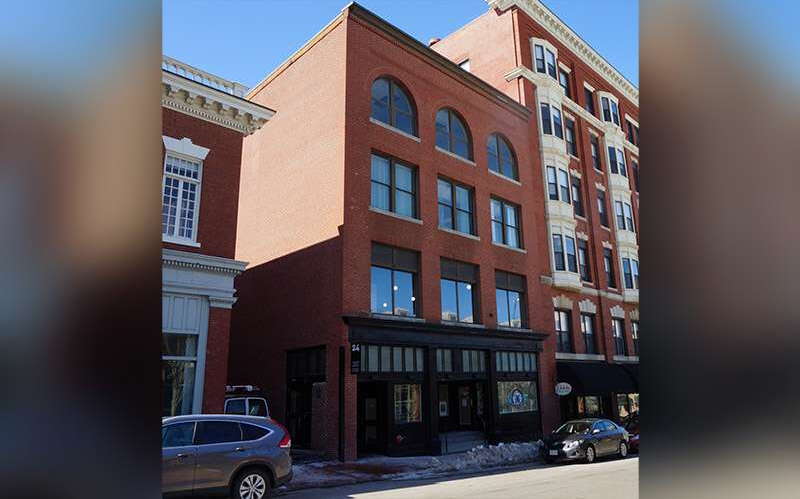

PHOTO / COURTESY, BONDEKO

Bondeko Construction is an immigrant-owned business listed with the Greater Portland Immigrant Welcome Center. Earlier this year, Klara Horchler prepares to replace a water-damaged sill over the front door of Mayo Street Arts.

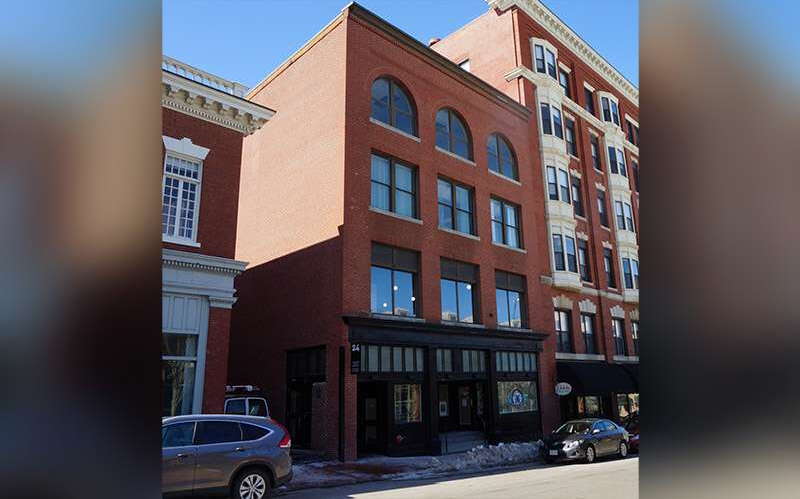

PHOTO / COURTESY, BONDEKO

Bondeko Construction is an immigrant-owned business listed with the Greater Portland Immigrant Welcome Center. Earlier this year, Klara Horchler prepares to replace a water-damaged sill over the front door of Mayo Street Arts.

The Greater Portland Immigrant Welcome Center is offering $4,000 microgrants that could provide a funding spark for immigrant-owned businesses in the city.

The grants are for startup or existing low- to moderate-income businesses, the center says, and are intended to increase opportunities for revenue growth and to help build credit and access to capital for future business opportunities.

The center’s business hub, through the support of the city of Portland’s Community Development Block Grant program, is now accepting applications for the 2024 Immigrant Entrepreneur Microgrants.

The awards require participation in a series of business skills workshops, according to the center. To apply, businesses must be located in the city of Portland.

The application deadline is Nov. 8, and more information is available here.

Microgrants

The microgrant program is one of a number of economic development initiatives offered by the Welcome Center, which considers entrepreneurship a key component of economic empowerment. The center’s mission is to serve as a hub of collaboration that strengthens the immigrant community through language acquisition, economic integration and civic engagement.

The business hub was created to help immigrants thrive as an integral part of the Maine business community.

The center says it draws on local and regional experts and economic development initiatives to provide technical support, mentoring, access to capital and know-how for immigrant-led businesses.

The offerings include seminars with experts from different business professions, access other resources, and the opportunity to connect with the others in the business community.

Main Street businesses

A major focus of the program is Main Street businesses, which the center defines as small, independently owned businesses.

“As the funding infrastructure is more robust for tech-based businesses, this funding is meant to bring equity to small ‘mom and pop’ businesses that bring so much to their local communities,” the funding announcement says.

The emphasis of the Community Development Block Grant program is on ‘microenterprises,’ defined as small companies of fewer than five employees.

The program’s guidelines say that “microenterprise development can be an effective self-sufficiency and empowerment strategy for a variety of special populations, including women and minority entrepreneurs."

In addition, many immigrant-owned Main Street businesses were left out of the pandemic relief process, for a variety of reasons, making their recovery and future uncertain, the announcement says.

There are a variety of eligibility requirements, income thresholds and restrictions on use of funds.

Eligible expenses include rent, utilities, inventory, minor equipment, insurance, payroll and other working capital needs. Grants can also be used for investments in business development support and services such as enrollments in business-related courses, hardware and software. Examples include accounting software subscription, online or in-person business course, marketing, purchase of point-of-sale systems or software.

Microloans and more

The business hub also focuses on center's partnership with the Indus Fund, a microloan fund dedicated to New Mainers looking to create a life for themselves and their families, catalyze their businesses, build credit and banking history, and help grow the Maine economy.

The Indus Fund is the brainchild of founder and managing partner Kerem Durdag. CPort Credit Union administers the micro-loans. Loans can be made to individuals or businesses for amounts between $500 and $10,000, according to the center.

The center's business hub also maintains an immigrant-owned business directory that includes categories such as automobile, cleaning, construction, consulting and educational services, event design, food and drink, nonprofits, personal care, retail, health care and social services.

Earlier this year, the center hired a new executive director, Faisal Khan, who was selected after a nationwide search and arrived with more than two decades of experience in human rights advocacy.

The center was co-founded in 2017 by Damas Rugaba and Alain Nahimana, who served as its first director.

0 Comments