Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

Growing pains: Maine life sciences, biohealth startups hustle to raise capital in a tough environment

Photo / Tim Greenway

Veronica Achorn, head of operations of Salmonics, in the manufacturing and research lab at TechPlace in Brunswick.

Photo / Tim Greenway

Veronica Achorn, head of operations of Salmonics, in the manufacturing and research lab at TechPlace in Brunswick.

A world apart from California’s Silicon Valley and greater Boston’s Route 128 technology corridor, Maine life sciences innovators are hustling to raise capital in a tough environment.

Playing to investors on both coasts, Chuck Donnelly of Portland-based RockStep Solutions — whose cloud-based software is designed to help drug companies and researchers get cures to market faster — tailors his sales pitch to the audience.

“I have two different pitch decks and I don’t like either of them,” he says. “On the West Coast they really want to see that you’re thinking big and you’re going to conquer the world, and on the East Coast they want to dig deep into the numbers. Both have their challenges.”

With around $15 million raised so far, including $13 million in equity, Donnelly is now seeking $7 million to $8 million in venture capital and strategic funding for the 50-employee startup he co-founded in 2015 with microbiologist Julie Morrison.

He’s doing so following a three-year slump in nationwide venture funding, culminating in a 42% drop last year to $248.4 billion, the lowest since 2017, according to a January report by CB Insights. U.S. venture capital transactions also sank to a 10-year low in 2023 as investors shied away from large, late-stage funding rounds and venture-backed IPOs fell to their lowest level in a decade.

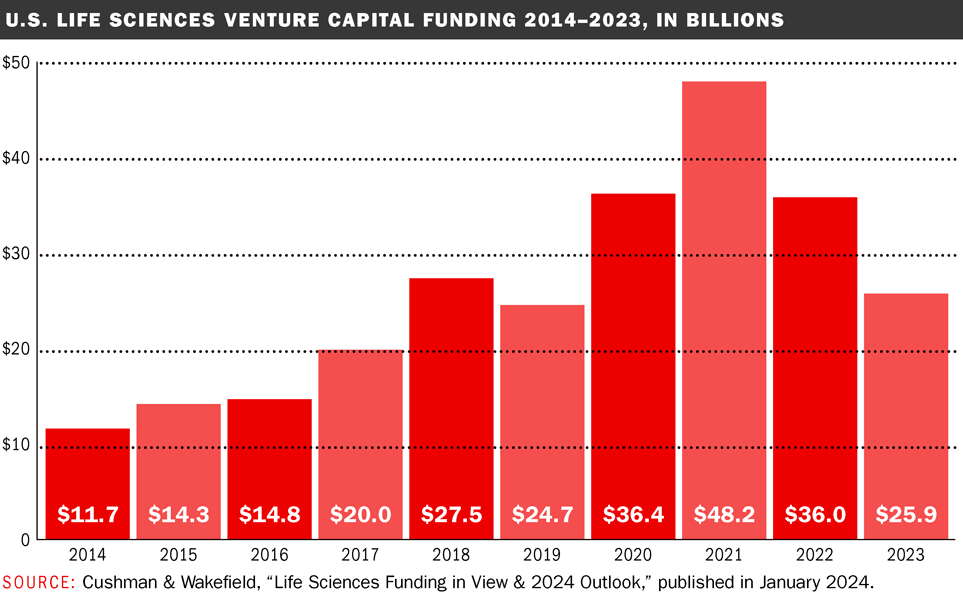

Another study, by commercial real estate company Cushman & Wakefield, shows a funding slump in life sciences, covering fields including biology, pharmaceuticals, biomedical technology and nutraceuticals. Last year alone, U.S. venture funding for life sciences dropped 28% to $26 billion amid higher interest rates and economic uncertainty, even though pharmaceutical companies posted a record $1.5 trillion in global revenue and mergers and acquisitions boomed.

But even in good times, early-stage Maine life sciences and biohealth startups frequently have to work harder than their peers in bigger markets to woo investors from out of state.

“We’ve had some wild success stories like Covetrus and IDEXX, some really big home runs, but we don’t have a lot of density in the state of companies of that level” to appeal to investors in Boston and other big VC markets, says Tom Rainey, executive director of the Maine Center for Entrepreneurs, which runs several business incubator programs.

“If Maine is going to be a player in the bioscience space, we need to create a lot more density.”

VC’s $300 billion ‘dry powder’

Signs point to a modest comeback in venture capital funding this year.

“In 2024, companies that meet investors’ key investment criteria, including successful progression in clinical trials and financial discipline, will attract funding,” says Sandy Romero, Cushman & Wakefield’s New York-based global research manager.

“Overall funding should be slightly higher this year given the strong clinical trials pipeline and significant dry powder available to investors.”

She estimates spending power of around $300 billion, of which $46 billion could be allocated to life sciences deals which typically account for 16% of the total.

However, she says that higher interest rates and tighter credit markets have made investors cautious in the short term, especially in response to shocks like last year’s failure of Silicon Valley Bank that roiled markets.

“When economic uncertainty abates, look for life sciences investment to rebound,” she says, predicting another banner year for mergers and acquisitions, a potential uptick in stock offerings and a more favorable commercial real estate market for life sciences companies.

She also notes that while large life sciences markets benefit from industry clusters, “emerging markets have been creating their own ecosystems through strong job growth.” Though she did not mention any regions by name, that bodes well for the Pine Tree State, whose $2.2 billion life sciences sector employs more than 9,500 people at 484 companies, according to the Bioscience Association of Maine.

But hiring skilled workers costs money, and many small startups turn to out-of-state venture capital when their expansion plans require more resources than those closer to home.

Scaling up at Salmonics

Maine startups in active fundraising include Salmonics LLC, a five-employee company based at Brunswick’s TechPlace technology incubator. The company, founded in late 2020, turns blood from farmed salmon into biomedical products for research and health applications.

The blood would otherwise be discarded as waste. “We are targeting ideally $1.5 million in order to provide us a 12- to 18-month runway,” says Cem Giray, the CEO and president, who plans to use the money to hire staff, promote sales of existing products, commercially launch new products in development and develop new ones for which the research has been completed.

Well aware of VC’s rough ride in 2023, Giray expects to land a third of the targeted investment amount within the next month and complete the round by mid-summer.

“I believe in our products, which are based on technology developed over 20 years by smart people, and there’s proof that it works well, which gives me confidence that it will work out,” he says. In addition, investors “are actually quite excited to find that there are companies like us in Maine. When they learn about TechPlace,” he says, “they’re surprised there is that much going on.” He also says that being revenue generating sits well with investors needed to fund the company’s next chapter.

“To take the next step I need to hire help, and that is not going to happen with me. That’s when you need investment,” he says. “I wish I knew that six months earlier, and that’s probably a piece of information that’s good for other startups to know before they stall.”

Digital health trailblazers

In the digital health niche, MedRhythms has raised $55.2 million in four funding rounds to date, including $19.4 million last November, an amount that includes equity as well as the conversion of outstanding convertible notes issued earlier in the year.

Founded in 2015 by Brian Harris and Owen McCarthy, the Portland-based company with Massachusetts roots recently released InTandem, an FDA-authorized “prescription music” device for home use to improve walking and movement in chronic stroke victims.

The company has a roster of 38 employees and 10 institutional investors. While around 80% of the $55.2 million comes from outside Maine, early rounds were tough.

“Initially, our location in Maine prompted questions from investors accustomed to biotech hubs like Boston or San Francisco,” says Harris, who has observed a shift in perception since the pandemic. “Southern Maine, in particular, has become increasingly attractive to startup companies and investors alike.”

Out-of-state investors, including Advantage Capital and Boston-based Morningside Ventures, account for 80% of MedRhythms’ total, while investors closer to home include the Maine Venture Fund.

“This distribution reflects our global appeal and the support of our local community,” Harris says. “It speaks to our vision of building a world-class company from Maine, showcasing our potential from here on the national and international stage.”

Reflecting on what he’s learned so far from courting investors, Harris underscores the need to articulate clarity and vision, establishing credibility early and emphasizing milestones. “Investors are keen to understand the tangible outcomes their capital will facilitate, making the explicit linkage between funding, milestones and value critical,” he says.

Similar to MedRthyms, Senscio Systems is a digital health startup with Massachusetts roots and strong ties to Maine.

Piali De, the company’s co-founder and CEO, makes the most of the ability to pitch remotely while keeping a Boston base to forge better connections with investors located there.

“Investors still care about our corporate headquarters,” says De, a Brown University-educated physicist and inventor. “Frequently in initial pitches, I am often asked, ‘Where are you headquartered?’ Then if I say, ‘In the Boston area,’ they say, ‘Let’s meet in person.’ It almost seems to check off a box for them that we’re the type of company they choose to invest in, so it does play to our benefit to have our technology and corporate headquarters in Massachusetts.”

Senscio Systems, founded in 2010, aims to redefine chronic care management with the nation’s first artificial intelligence-powered home-to-clinic digital therapeutics platform, called Ibis. Incorporated in Delaware, the company has a virtual workforce of more than 45 employees (including 11 in Maine) with a corporate base in Harvard, Mass.

The company, which has raised $16.5 million to date in five funding rounds, is seeking $10 million in a Series C round to expand from seven states today to all 50 by 2025.

“We’re courting both strategic investors and larger VCs for the Series C,” says De, who reports strong interest from digital tech funds, saying, “The questions are all around scalability.”

One takeaway from pounding the funding pavement is that “VCs are always looking for the next shiny object,” she says. “If you don’t explain what you’re doing, you’re a dull object by definition. To me the most exciting part of the pitch is to open people’s eyes to the art of the possible.”

Nor does she mind the pandemic-induced dynamic of meeting with investors remotely on Zoom.

“If someone is curious and we’re having a productive back and forth, that to me has replaced the warm fuzzy we get from being able to read body language,” she says, noting the importance of finding the right fit in both scenarios.

“Somebody once told me that getting a partnership with an investor is more serious than a marriage,” she says. “You can divorce your spouse, but you can’t divorce an investor.”

‘Playing the long game’

Despite venture capital’s appeal for many entrepreneurs, some prefer to tread more carefully.

That includes Michael Greene at GenoTyping Center of America, who says his nine-employee Waterville startup is working on bolstering its bottom line before nudging investors to put their money into a standard lab testing business.

“While there is significant growth opportunity for this testing, it is not innovative, groundbreaking or ‘sexy’ to investors, and the opportunity story is thus harder to convey,” he says. In addition, few investors have experience in the animal-testing niche the company is in, “which just adds hesitation and another hurdle to overcome.”

So far, the company has secured around $250,000 in grants, about half of which required matching funds; it also has its hands full after recent talks with a would-be acquirer that Greene says drained time and attention from running the business and was ultimately not a fit.

“We are refocusing on driving sales — our biggest challenge — before we look to pursue any venture capital,” he says. “We need to improve our profitability to become more attractive to investors.”

Similarly in Portland, Marin Skincare is in no hurry to raise additional funding after securing seed funding in the “low-seven figures,” according to Patrick Breeding, co-founder and CEO. The startup uses a lobster protein byproduct to make an over-the-counter hydration cream for sensitive, eczema-prone skin.

“Our approach to attract institutional venture capital is to avoid it for the time being,” Breeding says. “Accelerating our velocity of 100% year-on-year growth is not beholden to cycles of going out to raise every six to 12 months. It’s about playing the long game.”

At an even earlier stage with a mammogram-analysis startup, Kendra Batchelder is giving herself around two years before seeking a venture capital infusion. She teamed up with University of Maine bioengineering professor Andre Khalil to start WAVED Medical LLC after the two developed a patented computer algorithm for earlier detection of breast cancer.

“We’re only just now starting to calculate how much money we’re going to need,” she says.

0 Comments