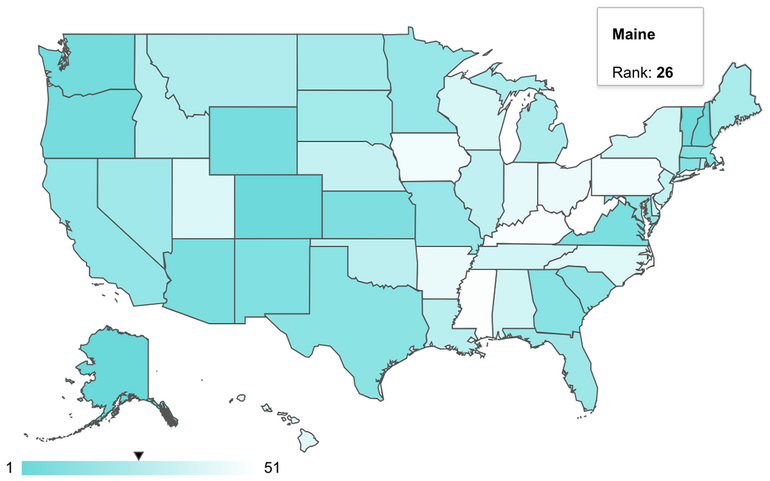

How Maine stacks up in terms of credit card debt

Map / Courtesy WalletHub

In WalletHub's ranking of 2023's Tates with the highest and lowest credit card debts, Maine was No. 26 overall.

Map / Courtesy WalletHub

In WalletHub's ranking of 2023's Tates with the highest and lowest credit card debts, Maine was No. 26 overall.

When it comes to credit card debt, Maine ranks in the middle compared to other states, a WalletHub report shows.

Overall, Americans increased their credit card debt by a record $179.4 billion in 2022, bringing the total owed to issuers of more than 1.1 trillion, according to the personal finance website.

To gauge which states have the least and most sustainable debt levels, WalletHub researchers looked at TransUnion credit data to calculate the cost and time required to pay off the median card balances in 50 states plus the District of Columbia.

WalletHub published its findings last week in its report, "2023's States with the Highest & Lowest Credit-Card Debts."

Alaska was found to be the most indebted state, based on a combination of the state's median credit card level and the cost and time for credit card holders to pay off the debt, while West Virginia was found to be the least indebted.

Alaska, nicknamed the Last Frontier, also had the highest median credit card debt, or $3,517). That's more than twice the level of least-indebted Iowa, where the amount was $2,077.

Maine came in at No. 26 overall, with a median credit card debt of $2,247, which takes 13 months and three days to pay off at a cost of $281. The $2,427 amount puts Maine at the eleventh highest debt level last year out of 50 states plus the District of Columbia.

Researchers noted that some states charge less than others for credit card debt, due to factors from inflationary impacts to varying degrees of fiscal responsibility.

More information

Find the full rankings and WalletHub report here.

0 Comments