Conversions to residential use offset downtown Portland office vacancies

File Photo / COURTESY CARDENTE REAL ESTATE

The downtown Portland office market vacancy rate rose by 2.8% over the past year, including a large vacancy at the 156,600-square-foot office tower at 511 Congress St., seen here in 2019.

File Photo / COURTESY CARDENTE REAL ESTATE

The downtown Portland office market vacancy rate rose by 2.8% over the past year, including a large vacancy at the 156,600-square-foot office tower at 511 Congress St., seen here in 2019.

Downtown Portland’s office market has experienced notable shifts and transformations over the past year due to the evolving dynamics of the area and changing work patterns, according to a report by Colliers of Maine, written by Kristie Russell, the firm’s research manager for Maine and New Hampshire.

A key trend that has emerged is the rising office vacancy rate, particularly in Class A properties, she wrote.

The increase is driven by companies adopting hybrid work models and by downsizing.

The rising vacancy rate, however, is slightly offset with office space being converted to residential development.

And there’s growing availability of sublease space and declining rental rates across all office categories.

Vacancy Rate

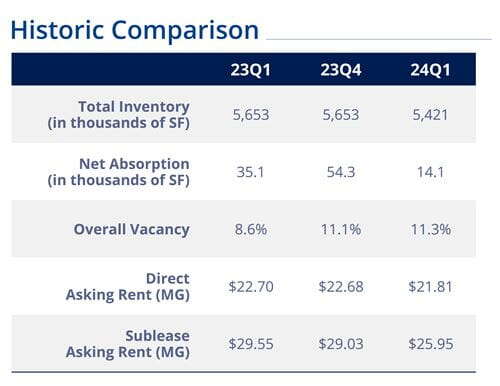

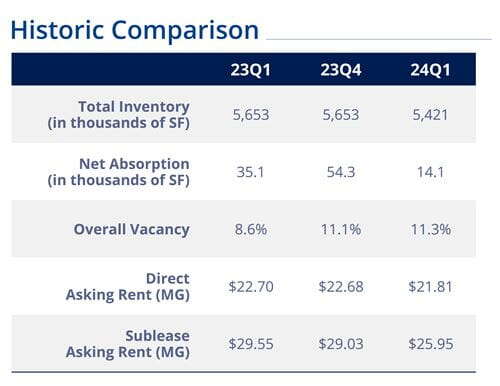

The downtown Portland office market vacancy rate rose by 2.8% year-over-year to reach 11.4% by the end of the first quarter of 2024.

Class A properties saw a surge in vacancy, by 4.8% over the last year, finishing the first quarter at 14.7%.

A significant factor to the increase was Maine Street Design Co. vacating 511 Congress St. at the beginning of 2024.

Maine Street Design Co. is a home goods store now at 160 Front St. in Bath, according to its website.

The 156,600-square-foot, 10-story office tower at 511 Congress St. received approvals last summer to convert into 107 housing units. Until the project progresses, the office space is expected to remain available for lease.

Earlier this year, Greater Portland Landmarks subleased 1,775 square feet of office space at 511 Congress St. in Portland from Embrace Home Loans

Conversion

The downtown office market is also affected by the conversion of partially empty office buildings to residential developments, removing vacancies from the market. Out of the three classes of properties, Class B buildings seem to be the most popular to convert, wrote Russell.

Over the past year, Colliers has tracked the removal of 230,000 square feet due to such conversions, removing 120,000 square feet of vacant space.

Other developments

The market has seen a general decline in asking rental rates across all office classes. Rental rates for Class A properties were more impacted by sublease rates than direct lease rates.

A contributing factor to the rental drop was the activity at 12 Mountfort St., which became available in early 2023 after Covetrus completed its new facility, creating a vacancy of 50,000 square feet. So far this year, OnPoint Health Data secured a 23,230-square-foot sublease and VETRO FiberMap subleased 5,830 square feet.

Colliers tracks 5.42 million square feet of office space in downtown Portland.

To view the full report, click here.

0 Comments