Processing Your Payment

Please do not leave this page until complete. This can take a few moments.

- News

-

Editions

-

- Lists

-

Viewpoints

-

Our Events

-

Event Info

- Women's Leadership Forum 2025

- On the Road with Mainebiz in Bethel

- Health Care Forum 2025

- On The Road with Mainebiz in Greenville

- On The Road with Mainebiz in Waterville

- Small Business Forum 2025

- Outstanding Women in Business Reception 2025

- On The Road with Mainebiz in Bath

- 60 Ideas in 60 Minutes Portland 2025

- 40 Under 40 Awards Reception 2025

- On The Road with Mainebiz in Lewiston / Auburn

- 60 Ideas in 60 Minutes Bangor 2025

Award Honorees

- 2025 Business Leaders of the Year

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- 2023 Business Leaders of the Year

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

-

-

Calendar

-

Biz Marketplace

- News

- Editions

- Lists

- Viewpoints

-

Our Events

Event Info

- View all Events

- Women's Leadership Forum 2025

- On the Road with Mainebiz in Bethel

- Health Care Forum 2025

- On The Road with Mainebiz in Greenville

- On The Road with Mainebiz in Waterville

- + More

Award Honorees

- 2025 Business Leaders of the Year

- 2024 Women to Watch Honorees

- 2024 Business Leaders of the Year

- 2023 NextUp: 40 Under 40 Honorees

- 2023 Women to Watch Honorees

- 2023 Business Leaders of the Year

- + More

- 2022 NextUp: 40 Under 40 Honorees

- 2022 Women to Watch Honorees

- 2022 Business Leaders of the Year

- Nomination Forms

- Calendar

- Biz Marketplace

With Camden National deal and others in the works, bank mergers seen to be picking up

Mainebiz graphic

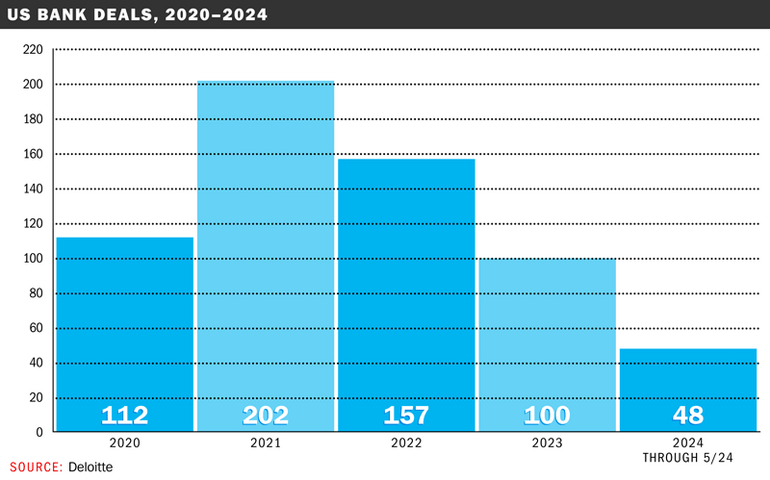

A total of 48 U.S. bank deals in 2024 had been announced as of May, according to a Deloitte mid-year outlook report published in August.

Mainebiz graphic

A total of 48 U.S. bank deals in 2024 had been announced as of May, according to a Deloitte mid-year outlook report published in August.

While Camden National Bank (Nasdaq: CAC) expands regionally by acquiring New Hampshire-based Northway Bank, and Gorham Savings joins forces with Maine Community Bank, experts are betting the industry's dealmaking pace will pick up as interest rates go down.

“We expect the momentum for mergers and acquisitions to accelerate over the next 18 to 24 months,” Gerard Cassidy, RBC Capital Markets’ Portland-based head of U.S. equity strategy and large-cap banking analyst, told Mainebiz in a phone interview.

Although the accounting treatment of bank assets such as bond holdings has made acquisitions more expensive, “that obstacle is melting away” as market interest rates have fallen, he noted. And the likelihood is growing that the Fed will soon cut short-term borrowing costs.

“If they follow through with that, and rates continue to fall, that’s going to be the catalyst for more transactions over the next 12 to 18 months,” he said.

U.S. central bankers are widely expected to start reducing interest rates at next week’s Federal Open Market Committee meeting.

Camden National, the second-largest Maine-based bank after Bangor Savings, announced plans to buy Northway earlier this week. If the $86.6 million all-stock deal gets the green light from regulators, it will create an entity with $7 billion in assets and $5 billion in deposits.

The tie-up between Gorham Savings and Maine Community, announced last December, will create an entity with nearly $2.7 billion in assets and a branch network across three counties. Though a formal effective date has not yet been set, the combined bank is expected to be operating on a single system by the third quarter of 2025.

Bigger picture

Both of the pending Maine bank deals come amid growth in bank mergers nationwide. Across the United States, the number of banks and thrifts has dwindled from more than 18,000 in the early 1980s to around 4,500 today.

“Whether you’re a bank with $5 billion or $50 billion or $500 billion in assets, scale is important,” said Cassidy, noting that consolidation is not linear but rather ebbs and flows.

Robust dealmaking in 2024 is documented in Deloitte’s mid-year outlook published in August.

Citing data from S&P Global, the report shows that the 48 bank mergers and acquisitions announced in 2024 as of May 20 have an aggregate value of $6.22 billion. That already surpasses the $4.18 billion aggregate value of the 100 deals announced in all of 2023.

Notable deals include UMB’s $1.99 billion proposed acquisition of Heartland Financial Corp. announced in April and South State’s $2.02 billion proposed acquisition of Independent Bank Group announced May 20.

“The first half of 2024 has shown promising signs for a bank M&A market rebound from the lows of 2023, and it appears the dealmaking will continue to strengthen as economic and regulatory uncertainties subside,” the authors note.

“As we move forward through the second half of the year and into 2025, it will be key for prospective acquirers and sellers to stay informed on the latest regulatory updates and to keep their integration playbooks sharp in an effort to achieve the smoothest path from deal to close to integration.”

Pressure to scale up

In Maine, industry insiders also expect continued consolidation.

“Maine has followed the national trend over many years in seeing consolidation within the banking industry,” said Andrew Silsby, president and CEO of Augusta-based Kennebec Savings Bank. “It’s simply harder to compete in today’s diverse financial service world without having scale to be able to offer the services customers want and expect.”

He also sees interest rates playing a role.

“With the rapidly increasing rate environment we have seen over the past two years, bank earnings have suffered at the hand of the Federal Reserve who has worked hard to slow the economy down,” he said.

While short-term rates are still above long-term rates, “that inversion is not a normal rate environment and so it makes it very hard for banks to make any kind of profit,” Silsby added.

“The longer short-term rates stay above long-term rates, the more consolidation activity we will likely see, both in Maine and nationally. The combination of lower growth and lower earnings will always spur on more consolidation activity, so this announcement is not all that surprising to me.”

Building economies of scale is another evergreen impetus for bank deals.

“Mergers and combinations in the industry reflect the growing regulatory burden being placed on banks, principally at the federal level, and the pressure on banks to gain economies of scale and efficiency,” said Jim Roche, president of the Maine Bankers Association.

For example, dozens of new regulations are introduced each year by "an alphabet soup of regulators" including the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Federal Reserve, the U.S. Department of the Treasury, he noted.

“While the U.S. banking system remains the envy of the world, policy makers must come to terms with the consequences of the regulatory burden they continue to place on banks and the communities they serve," he said.

Roche also said that while he doesn't expect more consolidation in Maine specifically, "the regulatory pressure hasn’t abated."

Despite shareholder pressure on publicly traded banks to bulk up via acquisitions, RBC's Cassidy noted that community banks like the ones all over Maine do not face those same challenges.

He also believes there will always be a place or smaller lenders, saying that "as long as the organization doesn't have accredit quality problem and has FDIC insurance, they're going to stay in business indefinitely."

0 Comments